What is Data Cloud?

In the ever-evolving landscape of financial services, staying ahead requires more than just data – it demands insightful, actionable information. Salesforce Data Cloud, formerly known as Salesforce CDP and Genie, emerges as a transformative solution, transcending its initial marketing-centric role to become an indispensable asset for financial organizations.

Data Cloud has broadened its native connectors, including integrations with platforms like Snowflake, AWS, and Azure enabling the ingestion of diverse internal systems and external data sources. This evolution positions it as a comprehensive solution for not only marketing but also for streamlining operational processes and enhancing customer experiences.

What Data Cloud is NOT…

Misconceptions about Salesforce Data Cloud often stem from the platform’s dynamic nature. One belief is that Data Cloud functions like a data warehouse or a data lake, but this is inaccurate. Unlike data warehouses and data lakes which store the organization’s entire data, Data Cloud is most effective for housing customer data and related events. Managing extensive datasets, including transactional data, within Data Cloud can lead to significant expenses.

To optimize the value of Data Cloud, it’s essential to view it as a tool for activating customer interactions rather than a platform for data analysis. In reality, Data Cloud is highly complementary to your data architecture for analytics and can mutually benefit with proper design considerations.

Why Data Cloud for Financial Services?

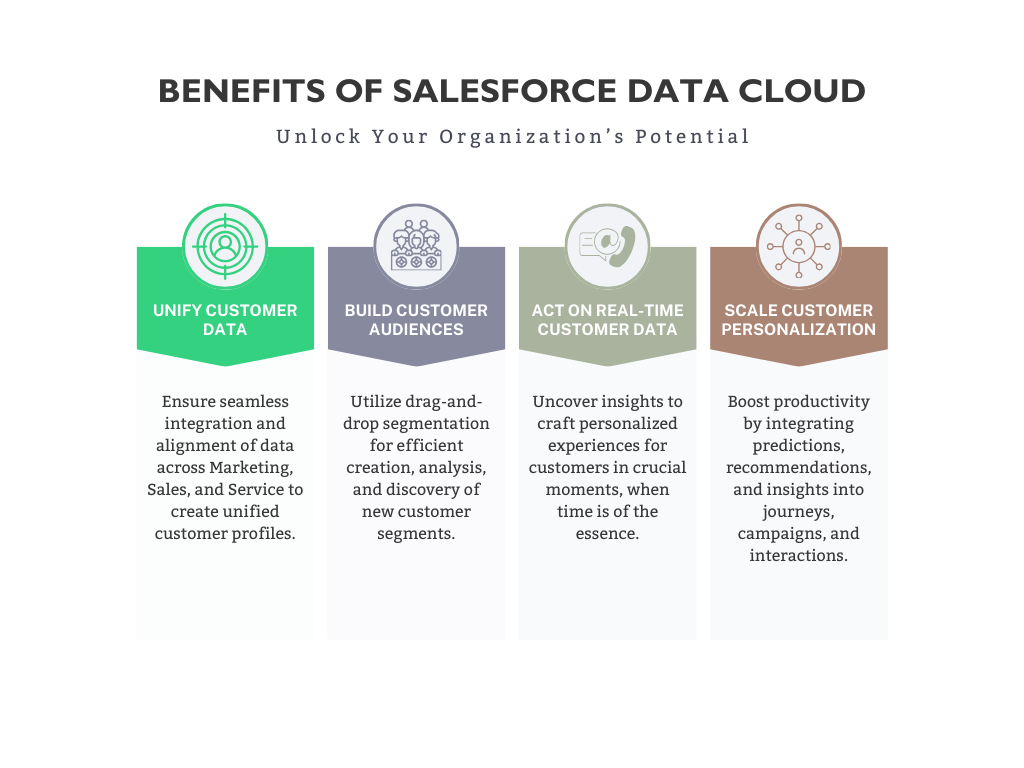

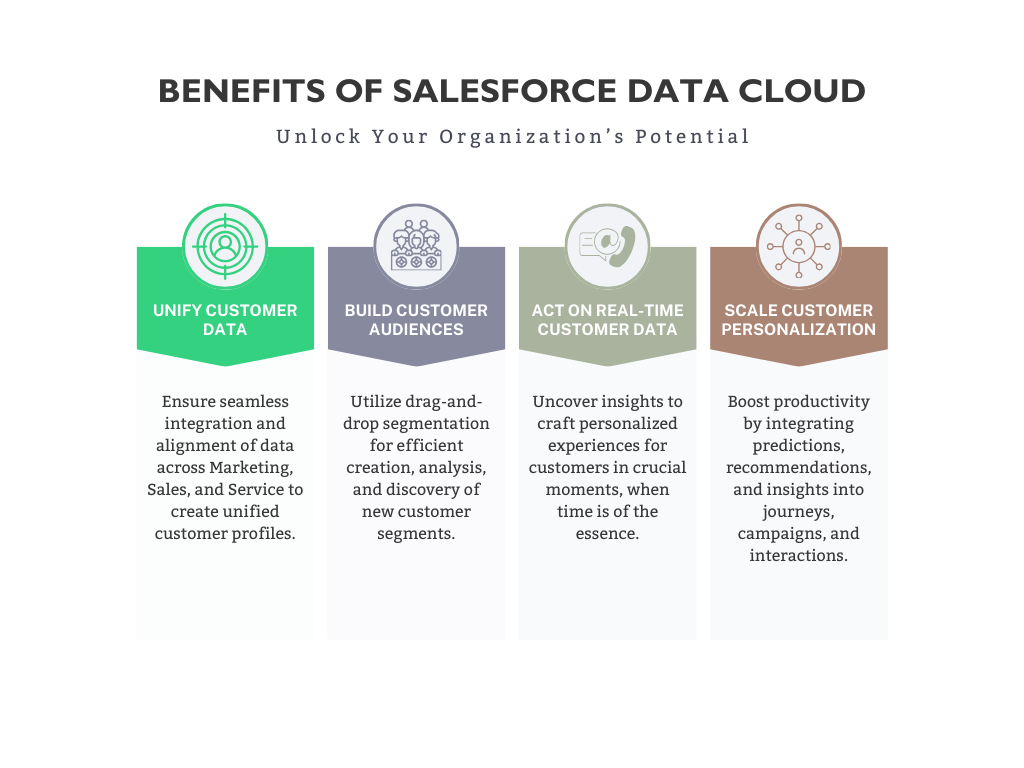

Salesforce Data Cloud proves to be a game-changer for banking institutions by seamlessly aggregating and unifying diverse customer datasets from various channels. This innovative platform enables banks to consolidate customer and engagement data into a comprehensive Customer 360 view, fostering a deeper understanding of each client’s financial journey and enhancing their Know Your Customer (KYC) processes.

Additionally, Propensity scores, engagement analyses, and sentiment assessments become not just possible but accessible, empowering banks and credit unions to tailor personalized offerings and interactions. Salesforce Data Cloud is instrumental in streamlining operations, ensuring compliance, and improving overall customer experiences, thereby positioning banking institutions at the forefront of data-driven innovation in the financial sector.

Use Cases that Data Cloud Enables:

- Personalized Customer Engagement: Seeing shopping preference and personalizing your webpage and offers to the customer.

- Tailored Messaging: Being aware of offers or promotions with targeted customers experiencing different life situations like marriage, retirement, or financial hardships.

- Customer Preferences: Communicating to the customer on their preferred channel when fraud or other security breaches occur, or alerting them for rewards and balance information.

What to Take Away…

The journey through the transformative capabilities of Salesforce Data Cloud in financial services has unveiled a paradigm shift in how organizations approach data. As the financial landscape evolves, the demand for personalized interactions with the customer have never been more critical. Leveraging Data Cloud enables those personalized interactions.

For financial institutions, the adoption of Salesforce Data Cloud becomes a strategic move, fostering innovation, strengthening your customer interactions, and placing your customers at the forefront of a data-driven revolution in the financial sector to gain that competitive edge.