Banks and credit unions around the country are facing technological challenges as they explore opportunities to increase effectiveness and streamline processes within their bank operations teams. Many regional banks have significant technical debt and siloed systems of record which seriously limits their ability to make fast, data-driven decisions.

On top of technological challenges, banking leaders must also overcome employee resistance to new technology and ways of working. Common reasons for the resistance are the fear of becoming obsolete and the trap of “we have always done things like this.”

Overcoming the technology side of change may be the easier challenge to tackle of the two. Leveraging platforms like Salesforce Financial Services Cloud (FSC) drives improved collaboration between branches, the call center and the deposit operations teams.

How can you leverage the “people side” of change within your bank or credit union to achieve success in a Salesforce FSC implementation?

Here are some tips on how we’re helping clients navigate this:

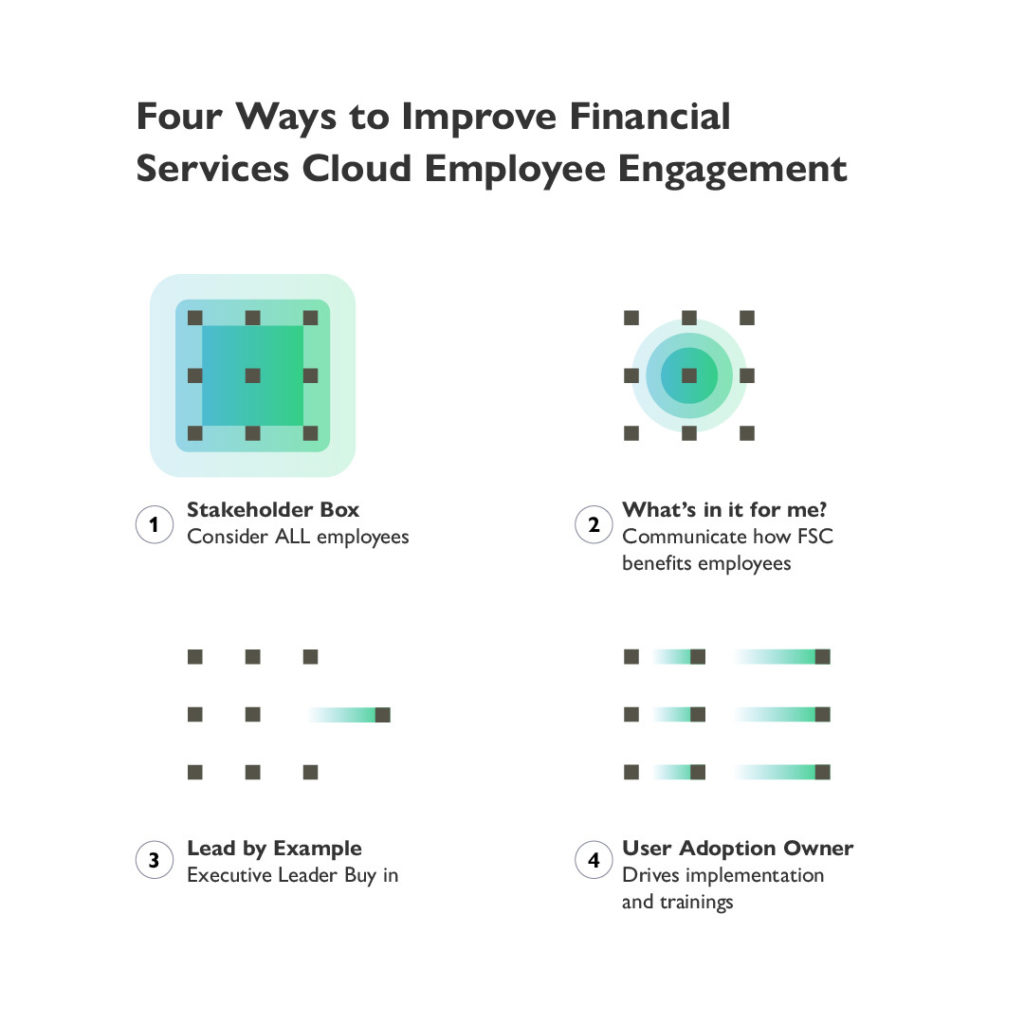

- Think outside the stakeholder box – Consider who will be using the system across the company, not just executive level.

- Clarify ‘What’s in it for me?’ – Communicate to all your employees why this is so important to their role and how it will help with their workload

- Lead by example – Executive level engagement from start to finish will drive change adoption

- Appoint a user adoption owner – An adoption owner can help drive implementation and trainings for users

Think outside the traditional stakeholder box

Focusing too much on the technology and not enough on the business process and outcomes can lead to the wrong results in a Salesforce FSC implementation. It is important to understand key business processes across bank roles from a teller, to a deposit operations team member, to loan operations, to a branch manager and all roles in between.

There is no better way to understand the behaviors, desires, and challenges than hearing it straight from the source. By including a larger cross-section of bank employees, you give them a stake in the outcome for the success of the FSC implementation, while also building a solution that serves their needs–closing the gap between requirements and results.

For example: consider hosting user interviews during requirements gathering to identify the areas that matter most to your bank employees, as well as challenges that they face in their day to day. Employees are ambassadors of the bank and involving a greater cross-section in a new implementation from the start can improve adoption. .

Help bank employees to understand “WIIFM”

WIIFM stands for “What’s in it for me?”

When it comes to change management, especially with technology, a personalized approach is the key to success and maximized adoption. WIIFM breaks down an overwhelming technological change into something that is relatable and individualized. Ultimately, you need to show your employees that you know what motivates them.

Relating to past feelings of frustration based on manual processes, and sharing the benefits of adopting FSC, can help employees understand and relate to the new technology. For example, data and process silos between different lines of business cause breakdowns in internal communication, which can hinder a personalized experience with each customer. Tailor communications to these roles, focusing on how Salesforce FSC enables them to see an enterprise view of customer data and transform customer satisfaction through case management and increased productivity.

Naturally, not everyone will get on board if the WIIFM message is delivered just once, or even twice. “Communicate early and often” – that is one of our project implementation mantras.

Lead by Example

Implementations of Salesforce FSC begin with bank leadership and branch managers. Branch leadership needs to be engaged throughout the implementation so they can be powerful champions when the solution is live.

The sooner leaders can run meetings out of Salesforce using reports or dashboards, the better. Having leadership communicate “if it isn’t in Salesforce it didn’t happen” will drive adoption. If employees don’t see their leadership embracing Salesforce, chances are they won’t either. Simple as that.

Appoint a User Adoption Owner

Training is a must for effective change management. Email is not enough. Bank employees need more than just an announcement. Also, resistance is real — employees’ natural tendency is to resist change for new and unfamiliar technology.

Plan for training and user adoption early with any FSC implementation. Identifying an internal change management lead who can “own” user adoption will help to kick-start successful implementation.

Training opportunities and materials can help to combat resistance by giving them an opportunity to gather the knowledge of how to change successfully. Additionally, training should be multifaceted and the use of “office hours” after go-live can benefit any type of work setting (in-person, hybrid or remote) and drive engagement.

Once you complete training, analyze adoption metrics and have a mechanism for bank employees to submit feedback or requests (to be prioritized by leadership) after launch. This can be a powerful tool for adoption and a reminder that their voices matter. With FSC, you can use case management features to facilitate internal feedback and leverage reports and dashboards to analyze user adoption across the board.

Engaged Employees are Empowered Employees

Curating a thoughtful approach to a FSC implementation is key to driving employee adoption. Apply the four tips outlined in this article to empower your employees with FSC.